How the greed of banks and the ineptitude of regulators took us to the brink of Armageddon – requiring a bail-out we are still paying for, and where we’ve learned almost no lessons.

We’re all set to repeat the whole process with potentially worse consequences.

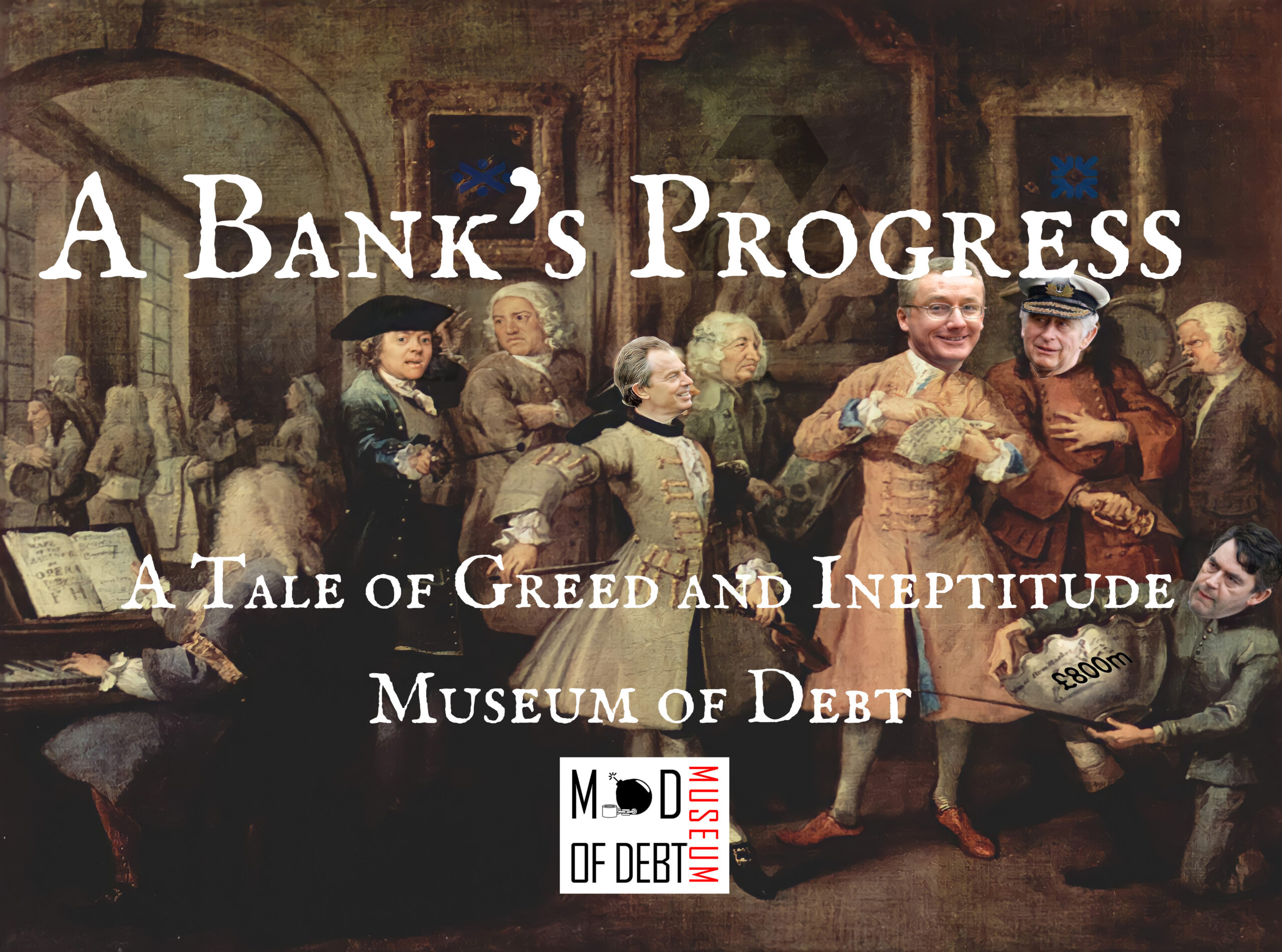

Our story is told with the help of William Hogarth’s series of images called The Rake’s Progress.

This book is an account of how greed, ambition, and incompetence within the banking industry—enabled by lax regulation—led the global economy to the brink of collapse. Using the artwork and the obvious parallels to William Hogarth’s The Rake’s Progress, it chronicles the rise and fall of the Royal Bank of Scotland (RBS) as a microcosm of broader systemic failure, offering a sobering reflection on how little we’ve learned from the crisis and the risks we still face.

The story begins with The Heir, where George Mathewson dreams of transforming RBS into a financial superpower. He hires Fred Goodwin, “Fred the Shred,” whose aggressive leadership sparks rapid growth, though neither Fred or George fully grasps the risks. The echoes of Scotland’s failed Darien Scheme foreshadow RBS’s eventual downfall.

In The Levee, Goodwin’s authoritarian culture takes hold, driving an audacious takeover of NatWest. Praised by the press and knighted for his success, Goodwin becomes a darling of government ministers enjoying the bank’s booming profits.

The Orgy follows RBS on a reckless acquisition spree, buying foreign banks riddled with toxic assets. The bank accumulates risky financial products—like credit swaps and subprime mortgages—that it barely understands.

As the cracks in the global economy appear, The Arrest describes how RBS outbids Barclays to acquire ABN Amro, despite mounting financial instability. Regulators fail to intervene, leaving RBS burdened with worthless assets.

In The Gambling House, RBS tries to stay afloat with a risky rights issue, but the collapse of Lehman Brothers triggers panic. Prison follows RBS’s desperate plea to the UK Treasury, leading to a £50 billion taxpayer bailout.

The book closes with The Madhouse, showing how little has changed. Lavish salaries and bonuses persist, and state-backed banks still dominate the economy. A Bank’s Progress warns that without meaningful reform, the conditions for another financial disaster remain in place.

Available in Bookstores as part of the Museum of Debt Series.

Leave a Reply