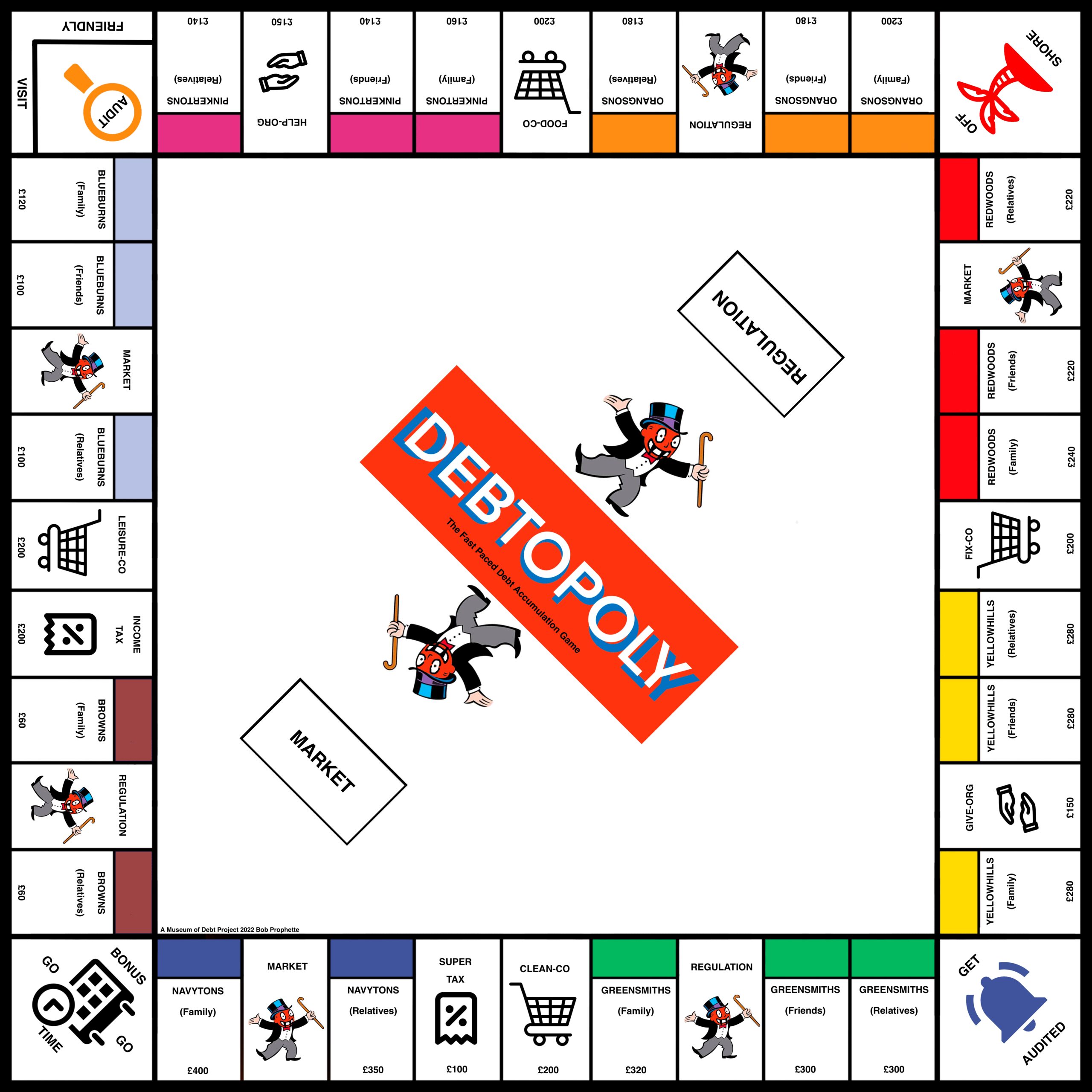

DEPTOPOLY is the classic game brought into the 21st Century. It’s money, not land, that’s being traded and monopolised to make the few rich and the majority excluded.

It’s rigged. The Economy. The rich get richer and the poor stay poor. On and on it goes until it inevitably crashes. The rich survive and the poor die. Bob Prophette

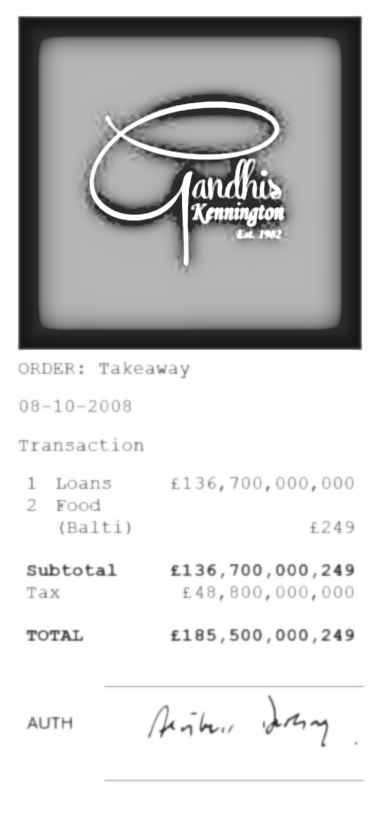

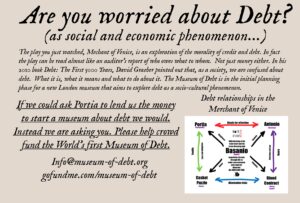

Following years of playing their own lethal version of Debtopoly, working tirelessly to get as much money earning as high an interest rate as possible, the Banks finally became so bloated and inefficient the banking system collapsed. In 2008 the Government summoned the top Bankers to Whitehall to tell them they would have to be accept a humiliating bailout – effectively nationalising most of them. The Banks were reluctant, wanting handouts instead. As negotiations progressed into the night the Treasury Officials ordered a curry to feed the bankers and keep them talking. This work commemorates the now infamous Balti Bail Out which occurred on 7th October 2008. 14 years later the Banks still have not paid back the taxpayer for their investment and its likely that even if they do, they’ll be paying much lower interest than they change us. Deptopoly, created by Bob Prophette is a fully functioning version of the classic game where players compete to get families, their friends and relatives into debt. The more in debt they can get them, the higher the interest they can change, as only the banks have money to lend.

THE RULES OF DEBTOPOLY

Debt repayment interest is the new rent extracted from the economy. The aim of the game is to get as much of it earning as high an interest rate as possible.

How to Win

Move around the board selling as many financial products as you can. The more products you sell, the more indebted the world becomes and the more interest you earn. If you accumulate enough, you will become too big to fail and win.

The Board Spaces

Unindebted families, their relatives and friends.

At the start of the game there are eight families. The Browns, the Blueburns, the Pinkertons, the Orangesons, the Redwoods, the Yellowhills, the Greensmiths and the Navytons. Each family has its own set of relatives and/or friends making up the Family Set. When you land on an unindebted space, you pay the amount shown on the board to obtain the right to be able to sell financial products to them. Then, when another player lands on a space that you own, you take a repayment out of the economy and keep it for yourself.

Business and Charities

In addition to the families, the Family Sets, there are also Business and Charity Organisations. When you land on an unindebted business or charity space you must pay the amount shown on the board to be able to lend to them. Then when another player lands on that space you receive the repayment. This is higher the more businesses and charities you own.

Regulator and Market

When you land on a space marked Regulation or Market you must draw a card from the relevant decks and undertake the action that is required. Unless stipulated return the card to the bottom of the pile.

Go Bonus Go Time

This is the starting position for all players. It’s the start of the financial period. Each time you pass Go, you receive a £200 Bonus.

Audit and Get Audited

When you land on Audit normally nothing happens. This is just a friendly visit. A boozy lunch maybe. However, when you land on the ‘Get Audited’ square or you are instructed to go to Audit by one of the regulation Cards, you must go directly to the Audit space. If you pass go you must not collect a Bonus.

To get out of the Audit you can make a £50 donation to the auditor, or you you can use a Get out of Audit card. If you don’t have one you can offer to buy one from one of the other players. Alternatively, roll a double and you are free to move that number of spaces.

Offshore (Free Parking)

Here you are safe. You can stay here, earning money when other players land on squares that you own.

Trading

When you land on an unindebted space you must pay the sum specified in order to offer financial products. If you do not wish to pay, that square must immediately be auctioned to the highest bidder.

You can trade at any time in order to have all of the members of a Family Set (the family, its friends and relatives) indebted to you. You can simply agree to swap Families Sets or buy and sell them. By owning a Family Set, you can sell even more financial products (they no longer have any alternatives as everyone they know is also indebted to you!). Each product costs the amount shown on the repayment card which also specifies the repayments you receive when another player lands on your space. The products are: Overdraft, Credit Card, Loan, Mortgage. Once you have a mortgage you can trade in all other products for a 2nd mortgage and receive the highest repayments possible.

The Economy

In DEPTOPOLY there isn’t a Bank. The players take on this role. Instead, money is held in the Economy. When you lend to a Family, the money is magically created allowing them to repay you from their work. What’s not magically created is the interest. The extraction of this interest from the economy is effectively what leads to economic polarisation over time.

A Museum of Debt Project.