***NOTE: UKGI COMPLETED THE SELL OFF OF THE TAXPAYER’S REMAING SHARES IN NATWEST IN MAY 2025 (SEE PRESS RELEASE HERE). THE RECIEPT AND THE CONTENT BELOW WILL BE UPDATED IN DUE COURSE***

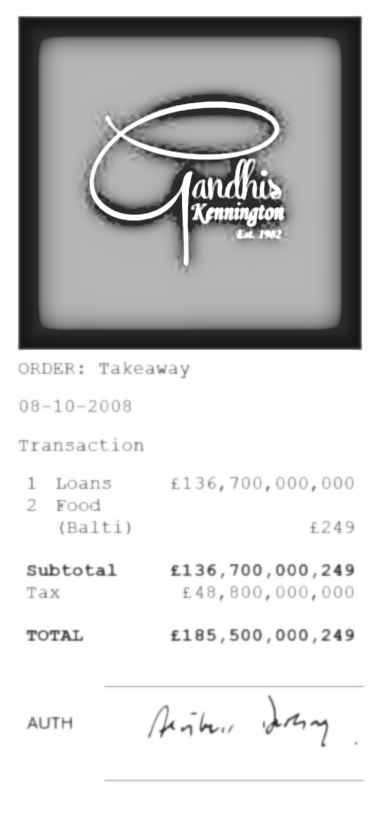

On the evening of the 8th October 2008 Alistair Darling, then Chancellor of the Exchequer, telephoned his favourite Indian restaurant, Gandhi’s in Kennington, just over the river from the Treasury premises. The curry was to keep top bank bosses well-fed and at the negotiating table to agree a massive bail out of some £50 Billion. The banks wanted handouts, not loans. This was on top of billions of pounds of support the previous year. To commemorate this inauspicious date the ‘Balti Bailout Receipt’ itemises the cost to the tax payer: the loan itself, the cost of the food, and not forgetting the additional taxes we had to pay to allow the Government to borrow the money to give it to the banks.

Alistair Darling stated in the House of Commons the following day:

…The taxpayer, therefore, will be fully rewarded for that investment.

And

…the risk remains with the banks and not the taxpayer; in other words, we get our money back.

And

…ensuring that the taxpayer is appropriately rewarded

And

…taxpayers will be rewarded for the risk that they take on

Source Hansard

After stating that the taxpayer would be repaid during 2018-2019, successive budget announcements have put this back to 2025-2026 (i.e. the banks have been given almost twice as long to pay the money back). Latest data from the Office for Budget Responsibility indicates that the UK taxpayer is due to ‘Take a Haircut’ – financial jargon which means not only are we not going to get much of a reward or return on our investment, we are actually not going to be fully paid back.

The reason is simple: the body responsible for selling the shares (UK Government Investments) has been quietly selling them back to the banks (mainly NatWest Group, formerly Royal Bank of Scotland) for less than it paid for them. Effectively the taxpayer paid 502p per share in 2008, the latest sale of shares back to NatWest was for 318p. The Museum of Debt estimate that given the remaining shares the public sector owns it will need to charge 5,127p (yes £51 per share) in order to give the UK taxpayer a decent return on its investment (7%). That’s what it will take for the taxpayer to be ‘fully rewarded’ and to ‘get our money back’ and for it to be true that the risk was ‘with the banks, not the taxpayer’.

While we are being stiffed by the banks, they continue to make profits. Their Return on Investment sits comfortably at 7% and has done since we bailed them out.

Leave a Reply